UK house prices starting to rise across the UK

Our House Price Index, which measures the rise and fall of house prices across the UK, reveals house prices have risen across all areas of the UK over last quarter.

House price inflation is no longer in negative territory and stands at 0% year-on-year, meaning the average house price is now £264,900, the same as it was a year ago.

Despite this, southern England does remain in negative territory in terms of annual inflation, although that gap is now lessening, while prices have risen elsewhere in the UK.

Sales market momentum is continuing throughout the build-up to the election, with demand for homes up 6% on this time last year.

The number of sales agreed is also up 8%, and we believe that 75% of the 1.1m sales projected for this year have already completed or are on their way through the pipeline.

We calculate that UK house prices are currently 8% ‘over-valued’, a hangover from the sharp price rises that took place during the pandemic, and we expect this to have rectified by the end of the year.

Overall, UK house prices are on track to rise 1.5% over the whole of 2024, a sign that the housing market is remaining resilient.

Our Executive Director of Research, Richard Donnell, says: “The housing market continues to adjust to higher borrowing costs and the summer slowdown is now arriving, tempering activity. The timing of the first cut in the base rate is key and will give a boost to market sentiment and sales activity.”

The average prices for different property types across the UK

The average price of UK properties is holding steady, with a minor increase of £110 month–on-month and an annual price change of 0% year-on-year.

Meanwhile, if you’re a buyer, this could be the time to look into detached propertes, as they are now nearly £2,300 cheaper than they were this time last year.

Equally, flats and maisonettes are down in price, and are now £2,000 cheaper on average than this time last year.

Property type | Average house prices in March | Average house prices in April | Average house prices in May | £ annual price change | % annual price change |

All property | £264,300 | £264,700 | £264,900 | £110 | 0.00% |

Detached | £445,800 | £446,400 | £447,500 | -£2,290 | -0.50% |

Flats/Maisonettes | £190,400 | £190,700 | £191,100 | -£2,030 | -1.10% |

Semi-detached | £269,100 | £269,300 | £270,100 | £1,950 | 0.70% |

Terraces | £232,700 | £232,700 | £233,600 | £1,910 | 0.80% |

Where are UK house prices rising and falling in June 2024?

Regions where house prices are rising

Homes in Northern Ireland have seen the biggest rise in prices over the last 12 months, up 3.3%.

They’re hotly followed by homes in the North West (1.5%), the North East (1.4%), Scotland (+1.3%), Wales (+1%) and the West Midlands (+0.5%).

The lower property prices in these regions means there’s less of an impact here from higher mortgage interest rates, supporting demand and consequently, house price rises.

Down in Southern England, the picture is less rosy, with the East of England (-1.4%) leading the way in terms of house price falls.

It’s followed by by the South East (-1%), South West (-0.9) and London (-0.4%).

The East Midlands is also experiencing slight falls of 0.4%.

However, prices in these regions are starting to stabilise, and with prices starting to rise, the falls are now narrowing year-on-year.

Region | £ annual price change | % annual price change | Average house price |

Northern Ireland | £5,440 | +3.3% | £170,400 |

North West | £2,810 | +1.5% | £195,600 |

Wales | £2,060 | +1% | £204,000 |

Scotland | £2,050 | +1.3% | £163,200 |

North East | £1,980 | +1.4% | £142,500 |

Yorkshire | £1,300 | +0.7% | £186,600 |

West Midlands | £1,150 | +0.5% | £230,200 |

East Midlands | -£810 | -0.4% | £228,600 |

London | -£2,250 | -0.4% | £535,700 |

South West | -£2,790 | -0.9% | £312,900 |

South East | -£4,020 | -1% | £385,600 |

East of England | -£4,670 | -1.4% | £335,800 |

UK | £110 | 0% | £264,900 |

Top 10 cities where house prices are rising

Belfast is leading the way in terms of rising house prices, with homes here up 3.4% in the past year, a rise of £5,680, taking the average house price to £173,900.

It’s hotly followed by Rochdale (+2.7%), where prices have risen by an average of £4,460, taking the average house price to £170,100, and Bolton, where homes have gone up 2.3% (£3,790) to hit an average of £171,900.

City | £ annual price change | % annual price change | Average house price |

Belfast | £5,680 | +3.4% | £173,900 |

Rochdale | £4,460 | +2.7% | £170,100 |

Bolton | £3,790 | +2.3% | £171,900 |

Huddersfield | £3,860 | +2.2% | £178,700 |

Burnley | £2,770 | +2.2% | £128,600 |

Barnsley | £3,130 | +2% | £160,100 |

Wigan | £3,210 | +1.9% | £170,500 |

Bradford | £2,680 | +1.7% | £157,600 |

Manchester | £3,590 | +1.6% | £224,900 |

Blackburn | £2,190 | +1.6% | £175,900 |

10 cities where house prices are falling

Cities in the south of England are faring less well, with Ipswich leading the way in terms of house price falls. Prices here are down 3% year-on-year (an average of -£6,520), taking the average house price to £212,100.

In the coastal town of Hastings, house prices are down 2.8% since last May, a fall of £7,890, taking average house prices to £271,400, while in historic Norwich, homes have dropped 2.1% (£5,550), taking the average house price here to £260,900.

City | £ annual price change | % annual price change | Average house price |

Ipswich | -£6,520 | -3% | £212,100 |

Hastings | -£7,890 | -2.8% | £271,400 |

Norwich | -£5,550 | -2.1% | £260,900 |

Medway | -£4,910 | -1.7% | £285,800 |

Northampton | -£3,880 | -1.6% | £234,800 |

Brighton | -£6,320 | -1.6% | £398,800 |

Bournemouth | -£5,140 | -1.5% | £331,700 |

Milton Keynes | -£4,270 | -1.4% | £307,900 |

Aberdeen | -£1,850 | -1.3% | £137,400 |

Portsmouth | -£3,520 | -1.2% | £279,100 |

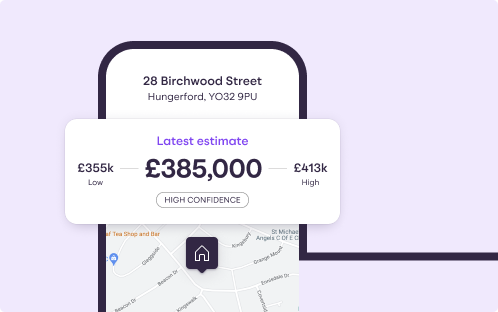

Want to know what’s happening in your area? Track your home’s value for regular updates.

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

Top 10 local authorities where house prices are rising

The north, where homes are traditionally less expensive than in the south, is seeing the greatest price growth in terms of housing.

Sunderland is leading the way, with prices up 5.2% year-on-year, a rise of £5,990, taking the average house price to £121,900. It’s followed by Dumfries & Galloway in Scotland (up 3%, or £4,830), where the average house price is now £148,000, and Lanarkshire.

Homes in North Lanarkshire are up just over £3,000, averaging out at £123,500, while homes in South Lanarkshire are up £3,700, averaging out at £146,100.

Local authority | £ annual price change | % annual price change | Average house price |

Sunderland | £5,990 | 5.2% | £121,900 |

Dumfries & Galloway | £4,830 | 3% | £148,000 |

North Lanarkshire | £3,110 | 2.6% | £123,500 |

South Lanarkshire | £3,700 | 2.6% | £147,100 |

Powys | £5,430 | 2.3% | £236,600 |

Shropshire | £6,280 | 2.3% | £277,900 |

Sir Ceredigion | £5,330 | 2.3% | £238,000 |

Scottish Borders | £4,030 | 2.2% | £183,800 |

Rochdale | £3,710 | 2.2% | £170,200 |

Oldham | £3,850 | 2.2% | £177,400 |

Local authorities where house prices are falling

Down in the more expensive south, prices are continuing to fall, after climbing rapidly during the pandemic years.

Leafy Kent and its seaside towns are taking a hit, with historic Canterbury leading the falls, where house prices have fallen -4.1% (£14,430) to an average of £339,300.

Canterbury’s followed by the coastal areas of Thanet (down 3.9% or £11,630 to £286,200) and Dover (down 3.8% or £11,630 to £293,400).

Prices in Essex are also down, with Tendring, Braintree and Colchester also experiencing falls of around 3%, or £8-10,000.

Local authority | £ annual price change | % annual price change | Average house price |

Canterbury | £14,430 | -4.1% | £339,300 |

Thanet | £11,630 | -3.9% | £286,200 |

Dover | £11,640 | -3.8% | £293,400 |

Tendring | £8,010 | -3% | £258,500 |

Braintree | £10,270 | -2.9% | £341,300 |

Colchester | £8,830 | -2.8% | £301,800 |

Wealdon | £11,730 | -2.6% | £435,200 |

Rother | £10,010 | -2.6% | £375,400 |

Tonbridge Wells | £11,720 | -2.5% | £462,400 |

West Somerset | £7,640 | -2.4% | £304,800 |

Momentum continues in the sales market

Momentum in the sales market has continued over June, albeit at a slightly slower pace than the previous 2-3 months as the market is enters the quieter summer period.

And while house price inflation remains negative in the south, improving sales volumes over the first half of the year has led to a firming up of prices.

“All regions and countries of the UK have registered an increase in house prices on a month-on-month basis since January,” says Donnell. “But price rises are unlikely to pick up speed in the coming months.”

That said, on average, they are on track to be 1.5% higher at the end of this year.

75% of this years’ sales are completed or in progress

Our data shows the market is still on track for 1.1m sales this year, and three quarters of these sales have either been completed, or are working their way towards completion.

This figure is 10% higher than the number of sales that took place in 2023 but still below the 20-year average.

“It is positive that sales are rising despite higher borrowing costs,” says Donnell. “It shows more realism on the part of sellers and renewed, cautious confidence amongst buyers.”

How higher mortgage rates have affected house prices

The housing market has been very resilient over the last year given the rise in mortgage rates. These averaged below 2% in late 2021 and stand at 4.7% today, spiking well over 5% in October 2022 and again over the summer of 2023.

“Higher borrowing costs have reduced the buying power of new buyers. But rather than sizable price falls, the main impact has been a sharp decline in the number of sales, which were 23% lower over 2023,” says Donnell.

“House prices haven’t fallen as there have been few forced sellers. And unemployment has stayed low by historic standards, meaning there are a relatively small number of people struggling to pay their mortgage and falling into arrears, despite wider cost of living pressures.

“We expect house price inflation to remain muted, likely to rise more slowly than household incomes over the next 1-2 years.”

Interest rates hold the key

Looking ahead, the near-term outlook for the sales market really depends on the outlook for mortgage rates, which are dependent on interest rates.

“Any reductions in the base rate over the summer and into the autumn will deliver a boost to market sentiment and sales activity, even though the impact on fixed rate mortgages will likely be more muted,” says Donnell.

“Based on city forecasts for base rates, we expect mortgage rates to remain in the 4-4.5% range going into 2025. This is sufficient to support sales volumes and low, single digit levels of house price inflation.”

Meanwhile, house prices in the south of England are expected to continue to under-perform compared with the UK average, as prices realign with incomes.

“Real income growth will be the key to supporting sales and demand into 2025,” says Donnell.